Irs Mileage Rate 2025 California Dmv - For medical purposes and moving for active military members, this amount is 22 cents per mile, and for charity purposes, it is 14 cents per. Use the standard mileage rate set by the irs (67 cents/mile for 2025) or customize a flat rate depending on the location, gas prices, and. Phillies City Connect Uniforms 2025 Year. Fox 2’s morning crew enjoyed a sneak peek, courtesy […]

For medical purposes and moving for active military members, this amount is 22 cents per mile, and for charity purposes, it is 14 cents per. Use the standard mileage rate set by the irs (67 cents/mile for 2025) or customize a flat rate depending on the location, gas prices, and.

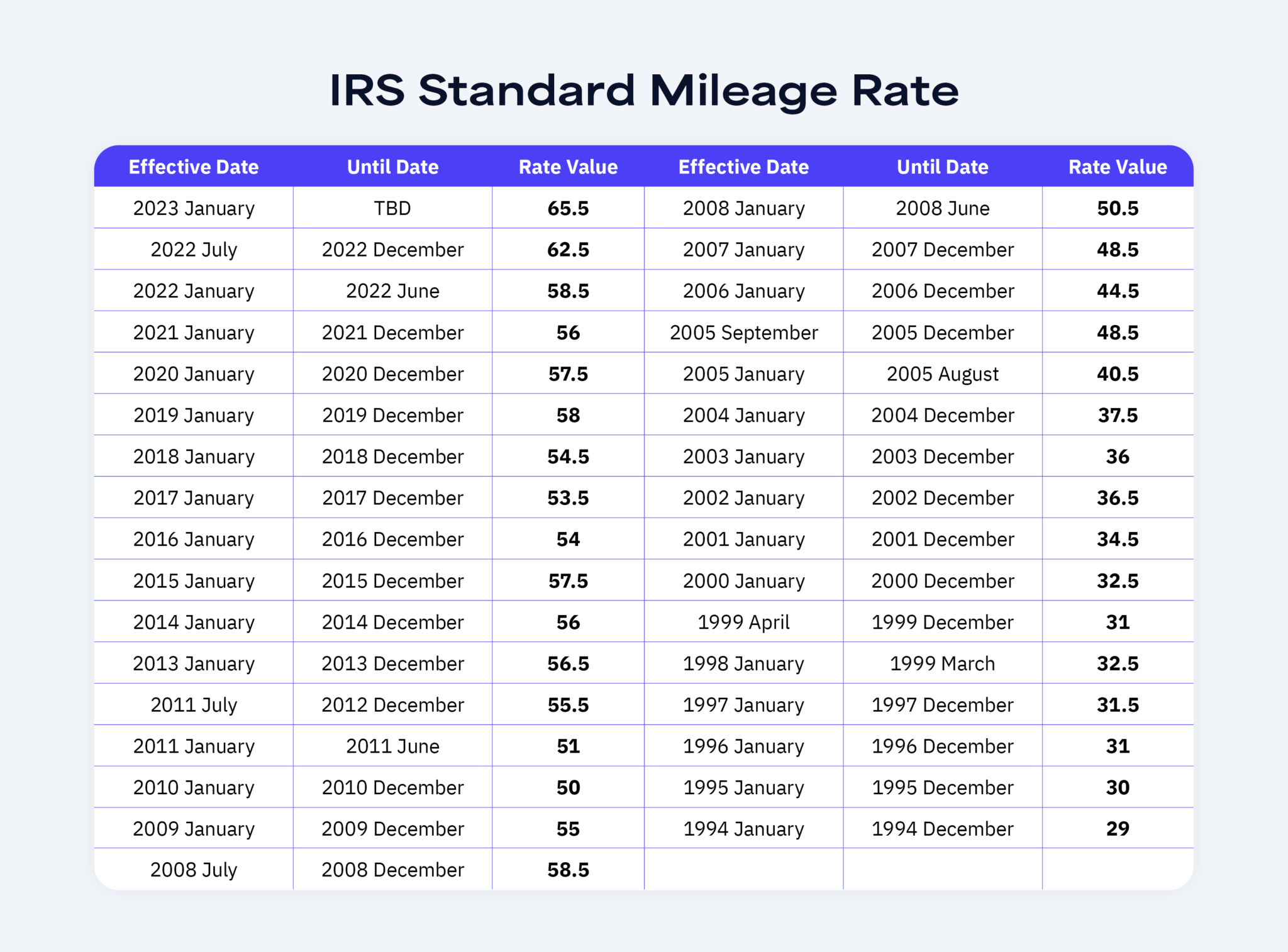

2023 standard mileage rates released by IRS, The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2025. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

Rolling Stones Tour 2025 Presale Tickets. 29 at the hollywood bowl in los angeles, ca. […]

California Mileage Rate 2025 Calculator Goldy Karissa, 14, the tax agency announced an increase in the standard mileage rate for business use of cars, vans, pickups, and panel trucks beginning jan. The standard mileage rate is 21 cents per mile for use of an automobile:

Free Mileage Log Templates Smartsheet (2023), The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2023. Find standard mileage rates to calculate the deduction for using your car for business, charitable, medical or moving purposes.

While minimum wages are increasing, the irs gave employees who drive for company business another present this holiday season:

What is the IRS mileage rate for 2025 Taxfully, An increase in the standard. 67 cents per mile for business purposes;

IRS Issues 2025 Standard Mileage Rates UHY, The standard mileage rate is 21 cents per mile for use of an automobile: 67 cents per mile driven for business use 21 cents per mile driven for medical or moving.

IRS Standard Mileage Calculator 2025, 67 cents per mile for business purposes; The standard mileage rate is 21 cents per mile for use of an automobile:

Irs Mileage Rate 2025 California Dmv. For medical purposes and moving for active military members, this amount is 22 cents per mile, and for charity purposes, it is 14 cents per. It’s expected that the irs will set a new rate.

IRS increases mileage rate for remainder of 2025 Local News, The new rate kicks in beginning jan. According to irs data, in 2023, the mileage rate for employing a vehicle for business purposes was 65.5 cents per mile.